Branded prices gain on Prime in 2020

MARKET UPDATE

Diving right in to the new year, we’ve already met some seaonal expectations in both cattle and beef prices.

We’ve seen a bit of strength in the fed cattle market over the past couple of weeks as packers showed their need to procure cattle. This is appropriate given the especially small slaughter head counts punctuated by the almost-idle day after Christmas. Keep in mind that big Saturday harvests, sometimes larger than 50,000 head, have been the method by which packers maintained higher weekly slaughter numbers.

The need for packers to re-engage product flow after the holidays helped lift prices roughly $4/cwt. in two weeks to average $111/cwt. last week with some cattle at $112/cwt.

Live Cattle Futures had been on a strong run, albeit choppy, since December 9th. Early this week we saw a major correction and then another reversal higher on the CME Live Cattle. All in all, analysts are pointing toward the generally higher trend and the targets for April and June contracts a handful of dollars above current levels. Cautious optimism is a general tone from the cattle sector.

Continuing with more seasonal expectations, the market has realized a deflation in cutout prices following the holidays. The Choice cutout price fell from $226/cwt. in mid-December to the most recent quote at $210/cwt. in last week’s average. Middle meats, especially ribeyes, have had their run-up to the holidays and those prices are now falling in normal fashion into early January.

Consumers now shift focus to the debt accrued over the holidays and dietary choices will follow with a look toward lower-priced cuts. As well, end meats are now more of a focus with winter weather and colder temps inspiring more household menus to feature roasting items.

BRANDED PRICES GAIN ON PRIME IN 2020

Supply factors took center stage for cattlemen in the past year as COVID-19 ravaged the marketplace. The backlog of finished cattle, carcass weights and price discovery have been such burning issues for months now it’s been hard to free up mental space for anything else.

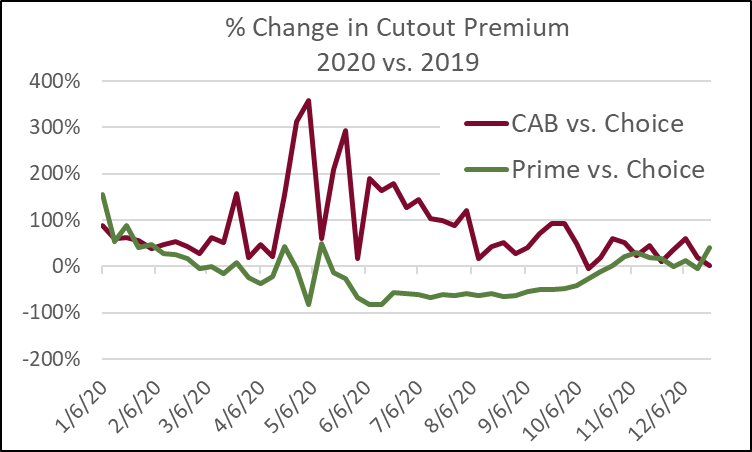

Yet as we look back, there appears at least one boxed-beef trend left largely unnoticed by many. That trend is the fact that prices for the “branded” product category, defined by USDA as both the upper two-thirds and low Choice brands, gained mightily on Prime in the wholesale beef market.

Understanding this first requires a look at what happened with supply and demand for Prime grade product. From the supply side, it’s easy to realize that record-large seasonal carcass weights created a spike in marbling-rich carcasses. During the most extreme three weeks in May the fed cattle average touched a 48-lb. year-on-year increase.

That mark would quickly fall to a 28-lb. average increase through year’s end. The unintended consequence of additional days on feed boosted Prime production an average of 20% above the prior year for May through December. Nothing was predictable in 2020, anyone could have assumed that the Prime premium over Choice would decline with the combination of an unforeseen influx of product and the extreme reduction in fine dining business. This came to fruition as the Prime cutout premium above Choice declined by 53% during those months, posting a recovery in the high demand period late in the 4th quarter.

What happened regarding the demand side of the “branded” category follows a less obvious narrative. This generalized category isn’t easily dissected by brand name or quality level, but since the CAB brand comprises most of this segment, we can speak to it from our brand perspective.

The supply side of the equation follows in line with that of the Prime tonnage increases outlined above. At the conclusion of the extreme packing sector interruptions CAB product supplies grew quickly as marbling levels increased with carcass weights. Weekly CAB carcass counts began to surpass prior year numbers by early June, continuing through year’s end at the pace of +38%, year on year.

The less predictable piece is that branded product prices narrowed the gap on the Prime grade from May through October. The Prime premium to branded products narrowed from $36/cwt. for that period in 2019 to just $13/cwt. in 2020. Yet the branded product category held a constant premium to Choice with a $5.87/cwt. premium in 2020 versus a $5.83/cwt. premium the year prior.

CAB brand pricing, specifically, outperformed projections throughout the same period. The CAB cutout premium was $17.78/cwt. over Choice, according to Urner Barry’s spot market values, 85% higher in the 2nd and 3rd quarters of 2020 than a year earlier.

Angus program-eligible cattle increase

Since the CAB® brand’s establishment in 1978, the live animal specification for eligibility has centered on black-hided cattle. In 2017 the standard evolved from a “51% contiguous black hide” requirement to a more objectively understood description. The current requirement is for a main body that is solid black with no color behind the shoulder, above the flanks, or breaking the midline behind the shoulder (excluding the tail).

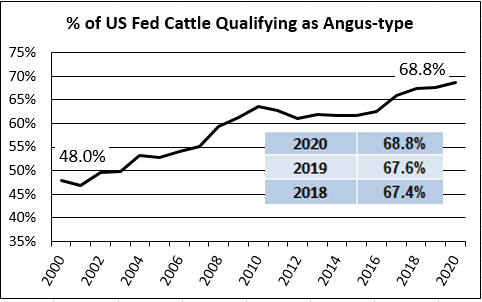

The industry trend toward more black-hided, Angus-influenced cattle and black cattle of other breeds has been on a strong trajectory for many years. Since just the year 2000, the industry has charted a 43% increase in black-hided cattle, as measured at packing plants and overseen by USDA.

The past year posted another notable increase of 1.16 percentage point, bringing the percent of US fed cattle qualifying as Angus-type to 68.8%.We anticipate another slight increase of potentially 1 percentage point in the coming year. A portion of this expectation is attributed to growth in the Angus x dairy steer population.

While a black hide is a requirement, it is also the lowest hurdle that each fed steer or heifer must cross on the path toward certification for the CAB brand. In the brand’s last fiscal year, just 36% of Angus-eligible carcasses earned certification by achieving all 10 carcass specifications. As has always been the case, the genetically higher Angus-based cattle are the drivers of the brand’s supply. Failure to reach or exceed Modest 00 marbling (the entry point to premium Choice) disqualifies more than 90% of eligible carcasses.

DON’T MISS THE LATEST HEADLINES!

Demand drivers bring opportunity

Your cattle, data and the grid

Nominate quality cattlemen for CAB awards by Jan. 17

Read More CAB Insider

$100,000 Up for Grabs with 2024 Colvin Scholarships

Certified Angus Beef is offering $100,000 in scholarships for agricultural college students through the 2024 Colvin Scholarship Fund. Aspiring students passionate about agriculture and innovation, who live in the U.S. or Canada, are encouraged to apply before the April 30 deadline. With the Colvin Scholarship Fund honoring Louis M. “Mick” Colvin’s legacy, Certified Angus Beef continues its commitment to cultivating future leaders in the beef industry.

Carcass Quality Set to Climb Seasonally

With the arrival of the new year the beef market will rapidly adjust to changes in consumer buying habits. This will remove demand pressure from ribs and tenderloins, realigning the contribution of these most valuable beef cuts to a smaller percentage of carcass value

Misaligned Cattle Markets and Record-high Carcass Weights

Few things in cattle market trends are entirely predictable but the fact that carcass weights peak in November is as close to a sure bet as one could identify. Genetic selection for growth and advancing mature size has fueled the long-term increase in carcass weights.